Тема: The nexus between ESG ratings and financial performance in emerging markets

Закажите новую по вашим требованиям

Представленный материал является образцом учебного исследования, примером структуры и содержания учебного исследования по заявленной теме. Размещён исключительно в информационных и ознакомительных целях.

Workspay.ru оказывает информационные услуги по сбору, обработке и структурированию материалов в соответствии с требованиями заказчика.

Размещение материала не означает публикацию произведения впервые и не предполагает передачу исключительных авторских прав третьим лицам.

Материал не предназначен для дословной сдачи в образовательные организации и требует самостоятельной переработки с соблюдением законодательства Российской Федерации об авторском праве и принципов академической добросовестности.

Авторские права на исходные материалы принадлежат их законным правообладателям. В случае возникновения вопросов, связанных с размещённым материалом, просим направить обращение через форму обратной связи.

📋 Содержание

1. Introduction 4

1.2 Research Relevance and Problem 9

1.3 Research Goal 11

1.4 Research objectives 12

1.5 Research Object and Subject 12

1.6 Characteristics of Research Methodology 12

1.7 Characteristics of research data: 13

2. Literature review 13

2.1 ESG concept 13

2.2 ESG in business 19

2.3 Theoretical approaches to ESG reporting 21

2.4. ESG in developing economies. 24

2.4.1 ESG in India and Brazil 25

2.5 ESG and Financial performance 31

2.6 The effect of State ownership in the ESG-FP relationship 35

3. Research design 38

3.1 Sample criteria 38

3.3 Variables 42

3.4 Methodology 48

4.1 Empirical Results 49

4.2. Discussion of results 62

4.3 Conclusion 65

4.4 Implications and Recommendations 66

4.5 Limitations and Future Results 71

5. List of references: 71

List of tables

Table 1. Active countries on ESG literature (Source: Anastasia Strekalina et al 2023) 10

Table 2. Variables Error! Bookmark not defined

Table 3. Descriptive statistics 49

Table 4. Correlation matrix 51

Table 5. Regression results for H1 53

Table 6. Regression results for H2 56

Table 7. Regression results for H3 58

Table 8. Regression analysis for H4 61

List of Figures

Figure 1. Associations with the word "Sustainability" in different countries 6

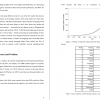

Figure 2. Number of empirical studies about the relationship of FP and ESG (Friede et al (2015)) 10

Figure 3. GDP contributions per sector in India 40

📖 Введение

Using ESG in developing countries is one way to boost its global reputation, which also has interesting implications for the future. Furthermore, public opinion, culture, and values also have a significant impact on how each nation embraces ESG. This is exemplified by a Latin American company study that revealed certain cultural dimensions such as masculinity versus femininity and individualism versus collectivism as well as indulgence versus restraint among others may positively or negatively influence environmental innovations’ effect on ESG performance (Paulo Vitor et al., 2024). According to this viewpoint, national cultural characteristics could moderate between novelty and effectiveness of environment-related practices within enterprise social responsibility both ecological and social components being taken into account hence it becomes necessary not only to transform those but also to create effective strategies applicable across different countries considering them too. Apart from the culture, people perceive world-famous terms differently depending on where they live. Sustainability, for instance, can be interpreted variously because individuals come from diverse contexts with dissimilar environmental settings that shape their understanding of it thereby leading to different public expectations from firms which in turn influences corporate strategies towards this end. In 2022 Ipsos Global Advisor created this diagram showing what people think when they hear global words. The study surveyed over 22 thousand individuals aged between 16 years old and 74 years old residing among 34 nations about sustainability word association where we can see more than one clear connection exists....

✅ Заключение

However, when it comes to accuracy and comparability between various ESG scores; availability as well as quality of data may be challenging in Brazil and India. On the other hand, this could also prevent from connecting financial performances with these ratings because of inconsistencies in reporting frameworks coupled with the absence of some details that can reveal a company’s actual ESG performance. Another thing is that disparities might arise from different methodologies used by several rating agencies to measure against each other while evaluating depending on how they measure these numbers too. Moreover, such rankings may fail to represent truthfully or fail to consider sector specific factors then results could distort genuine corporate performance regarding environmental, social and governance concerns. Future research can test this or any other hypothesis using alternative datasets like Bloomberg or S&P 500; it will help in understanding why businesses get different ESG scores besides revealing implications for firm value arising out of rating discrepancies’. This shall also add weight to such assessments. Furthermore, if further studies are conducted on costs associated with implementing ESG practices, firms may realize potential value appreciation and resource allocation requirements vis-a-vis financial impacts arising from integration.