Тема: Stock market reaction to earning announcement: Researched in Indian market

Закажите новую по вашим требованиям

Представленный материал является образцом учебного исследования, примером структуры и содержания учебного исследования по заявленной теме. Размещён исключительно в информационных и ознакомительных целях.

Workspay.ru оказывает информационные услуги по сбору, обработке и структурированию материалов в соответствии с требованиями заказчика.

Размещение материала не означает публикацию произведения впервые и не предполагает передачу исключительных авторских прав третьим лицам.

Материал не предназначен для дословной сдачи в образовательные организации и требует самостоятельной переработки с соблюдением законодательства Российской Федерации об авторском праве и принципов академической добросовестности.

Авторские права на исходные материалы принадлежат их законным правообладателям. В случае возникновения вопросов, связанных с размещённым материалом, просим направить обращение через форму обратной связи.

📋 Содержание

2. Literature Review 10-15

3. Final research goal 15

4. Final research question 15

5. Hypothesis 15-16

6. Data and methodology 16-31

7. Discussion and conclusion 31-33

8. References 34-35

9. Appendices 36-46

📖 Введение

The impact of earnings announcements on the stock market has been extensively studied in the area of corporate finance. Earnings announcements, usually referred to as corporate earnings releases or quarterly earnings reports, include important details regarding the present state of a company's finances and its prospects for the future.

The Indian stock market, one of the fastest growing and most dynamic markets globally, has witnessed a surge in earnings announcements in recent years, driven by the rapid expansion of the Indian economy, increased investor participation, and regulatory reforms aimed at enhancing transparency and disclosure standards. Against this backdrop, understanding the stock market’s reaction to earnings announcements in the Indian context becomes imperative for investors, policymakers, and market regulators seeking to navigate the complexities of financial markets and make informed investment decisions.

Prior studies have explored the role of earnings announcements in shaping market predictability and reducing information asymmetry. Initially, using Bayesian analysis, Lewellen and Shanken (2002) suggested that earnings announcements mitigate uncertainty in the markets, thereby enhancing predictability. However, subsequent research by Rogers et al. (2009) introduced a contrasting perspective, indicating that when firms release forecasts containing unfavorable news, market uncertainty persists or even rises. This implies a nuanced relationship between earnings forecasts and market uncertainty. Moreover, additional studies have challenged the notion that earnings announcements consistently reduce uncertainty. Pastor and Veronesi (2009) proposed a theory suggesting that as the content of earnings announcements increases, investor beliefs are revised, leading to heightened volatility and increased information asymmetry in the stock market. According to their theory, uninformed agents demand a higher discount to offset the risk of trading against private information as asymmetry grows, resulting in a positive association between trade volume and return volatility, particularly in periods of increased information asymmetry.

William H. Beaver (1968), one of the pioneers in analyzing stock reactions to earnings results, discovered that trading volume and stock price volatility both sharply rise during the earnings result period. The question comes whether or if decision-makers view earnings results or, more specifically, the informational content of earnings as having informational value. Beaver provides two definitions of information: (1) a shift in expectations regarding the result of an event, which is linked to higher stock price volatility, and (2) a shift in expectations that influences decision-maker’s behavior to sell or buy more, which is linked to higher stock trading volume. Beaver demonstrates both his importance and the fact that earnings results are seen as informative value among investor cycles...

✅ Заключение

The findings of the study reveal a significant relationship between earnings announcements and stock price behavior across different event windows, ranging from [t-5, t+5]. The event study methodology employed in the analysis, supplemented by Excel and Google Spreadsheet tools, facilitated a comprehensive examination of stock returns surrounding earnings announcement dates. The rejection of the null hypothesis that earnings announcements have no significant effect on stock price behavior underscores the importance of earnings news as a key driver of investor sentiment and market volatility in the Indian stock market.

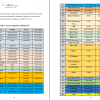

Specifically, the 9 values obtained for each event window demonstrate the magnitude of the reaction of stock returns to earnings announcements. The observed 9 values, such as 5.612388 for [t-1, t+1], 6.289675 for [t-2, t+2], 4.055828 for [t-3, t+3], 4.4276394 for [t-4, t+4], and 5.026486 for [t-5, t+5], all surpassing the threshold of 2, indicate statistical significance. These results suggest an aggressive reaction of stock returns to earnings announcements during the initial two days following the announcement, followed by a gradual normalization of reactions from the third day onward.

In this study, notable observations highlight the pronounced reaction to earnings announcements, particularly evident one day after the announcement in t+1, with an abnormal return value of 5.72922. This finding suggests that investors may promptly act upon information gleaned from company webcasts/earnings calls, potentially indicating a proactive approach towards future investment decisions. Moreover, the substantial abnormal return value of 3.0125 observed two days prior to the event date (t-2), the second highest abnormal return recorded, may signify pre-existing information asymmetry preceding earnings announcements. This asymmetry gradually diminishes to -0.208 in t-1 and further to -2.94421 in t0, indicating investor behavior primarily occurring two days before the event date, followed by an aggressive response the day after. These observations underscore the intricate dynamics at play surrounding earnings announcements and investor decision-making processes.

Overall, the answer for the research question “Does earnings announcements affect the behavior of stock prices in India’s NIFTY50 index, and does these changes in effect depend on the various time frames around the announcement date?” is YES....